The Funding Round is Dead

When reading about Tilt’s latest funding round, I was struck by a quote that currently epitomises the venture industry.

“We weren’t in fundraising mode — there was strong outside interest with minimal dilution, and Khaled and I felt like it was the right move for the business,” Tilt CEO James Beshara said.

In my last few years with Balderton, I’ve noticed the term ‘fundraising mode’ has become almost non-existent, while ‘strong outside interest’ is now a de facto of every one of my board meetings. While each company and deal is different, one thing has become increasingly clear: the formal funding round is dead.

Investors and founders used to be able to wait until a company was 3–6 months away from cash-out before engaging in a formal process. But with competition rife, richer data and greater market volatility, the traditional funding process has changed.

Companies in our portfolio increasingly don’t timetable their funding rounds, instead they build plans towards certain goals, and respond to opportunities as they come. This doesn’t mean you should take whatever cash is going ( or any external funding if you don’t need it ), but it has changed the way VCs operate. So what’s driving this, and what should founders be doing to respond?

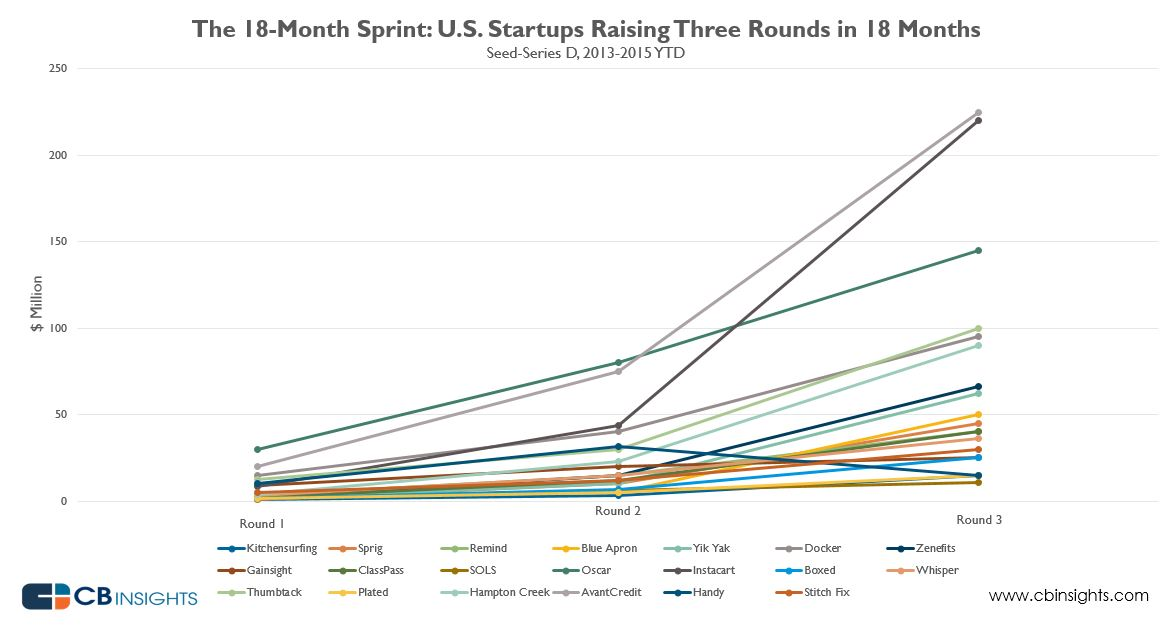

Speed of change: none of these rounds were in the plan..

Venture is more proactive than ever

A key reason for the end of the formal funding round is that venture capitalists are in hunter mode. The increased amounts of capital in early stage technology markets mean that investors just don’t have the luxury of being able to sit and wait for rounds to come to them.

On top of this, the vastly increased amount of public data around every company means investors are now armed with the tools to form a view about a company before receiving a formal pitch. In the past, we relied on NDA-protected, broker designed pitch deck to understand how a company is doing (I still get nauseous at the sight of a watermark). Now our CRM allows us to instantly see the number of employees, social traction, and progress in multiple distribution channels (whether App Store, Github or beyond) before speaking to a company, allowing us to be much more proactive in our approach.

Growth matters more than ever

The focus of founders has changed too. The cost of building most types of product has fallen dramatically, meaning that execution is now the key competitive advantage. The best measure of successful execution is growth in both revenues and margins. As soon as a company finds a way to sustainably grow these metrics, it doesn’t make sense to wait until your planned funding period and risk losing your differentiator. Instead the current market of cheap money means that founders want to throw fuel on the fire as soon as possible.

*“We’re planning on doing our Series A in 3 months” (RIP, 2004–2014)*

Conviction matters more than ever

In an increasingly competitive world, there is no time for rumination. This does not mean that investors should shoot from the hip, but thumb-twiddlers will be left behind. We have more data on markets and companies than ever before, and the ability to do much more granular due diligence. But if we do approach a company to discuss investment, we know we can’t then waste their time by taking months to come to a final decision. The heat is on: indecision is fatal.

So, if the old-school funding round is dead and buried, how can founders make this work to their advantage?

Manage to KPIs, not a timetable

One of the favoured investor questions of old was “how many months of runway does this capital give you?”. But in a world when growth is king, runway matters less.

The question that entrepreneurs should be asked isn’t about runway, but instead: where does your current capital get you? What metrics do you care about hitting with the capital you have? “I have enough money to last six months” is a far less useful statement than ‘ I have enough money to get me to XXX MAUs, MRR or EBITDA.

While managing cash and burn will keep you alive, you’ll be a zombie unless you manage to grow as well.

Be open

In the same way that investors are becoming more transparent, companies have to be too. There is no point in NDAs or no-number teasers in a world where tools like Mattermark & CBInsights are scraping mentions of your business on twitter daily. Even when things aren’t going well, it will build confidence in you as a manager and leader if you are open with potential investors on current metrics and your goals.

Take the call, but be wary

In a more proactive investor world, you’re going to have to deal with more inbound emails and calls from investors like me. While you don’t want to waste time talking to everyone, you should find canny ways to keep people informed.

A simple approach is a regular ‘investor update’ email to a list of warm contacts. By doing so, you cultivate a group of informed investors to call when you hit your growth metrics, and you have a perfect excuse to ask for favours and see who is really supportive in advance. Keeping investors informed is the only way to raise quickly a round and get back to executing.

This also means you can push off the hanger-on investors, who will always tell you they’re excited, but never really help you out or pull the trigger on an investment.

As always, we love getting feedback on the experiences of other founders and investors, so get in touch via jwise@balderton.com, or @jp_wise