Balderton's $1.3B fundraise and conviction investing

I have a bug bear with most fundraising announcements. While it would be great to see more media coverage of technological breakthroughs and entrepreneurial journeys (see our own efforts at What's Next), a fundraise is usually a lagging indicator of success, and rarely a newsworthy moment itself.

So it would be hypocritical of me not to try and explain why Balderton’s latest $1.3B fundraise, combined across our early and growth funds, is worth writing about.

Firstly, venture capital matters. After a couple of years of more bad than good news for venture-backed companies, it is important to re-iterate that when it works, venture capital is one of the most important financial instruments in the world.

Venture funds have a mandate to provide patient, high risk capital to technology companies that can have impact on a global scale. Patient capital is important - as anyone looking at today’s financial markets will see, public equity and debt markets are highly volatile, and building a category-defining company is hard enough without having to worry about what the global macro environment is doing on a daily basis. It’s why I was always concerned about SPACs, tokenisation and early IPOs as options for financing technology companies, illiquidity is a benefit not a flaw when building a new company. Having an investor like Balderton that can hold its stake for over a decade, and will provide an average of 2-3 years runway for your company in a single funding round, is a blessing as any entrepreneur that doesn’t have access to venture capital will tell you.

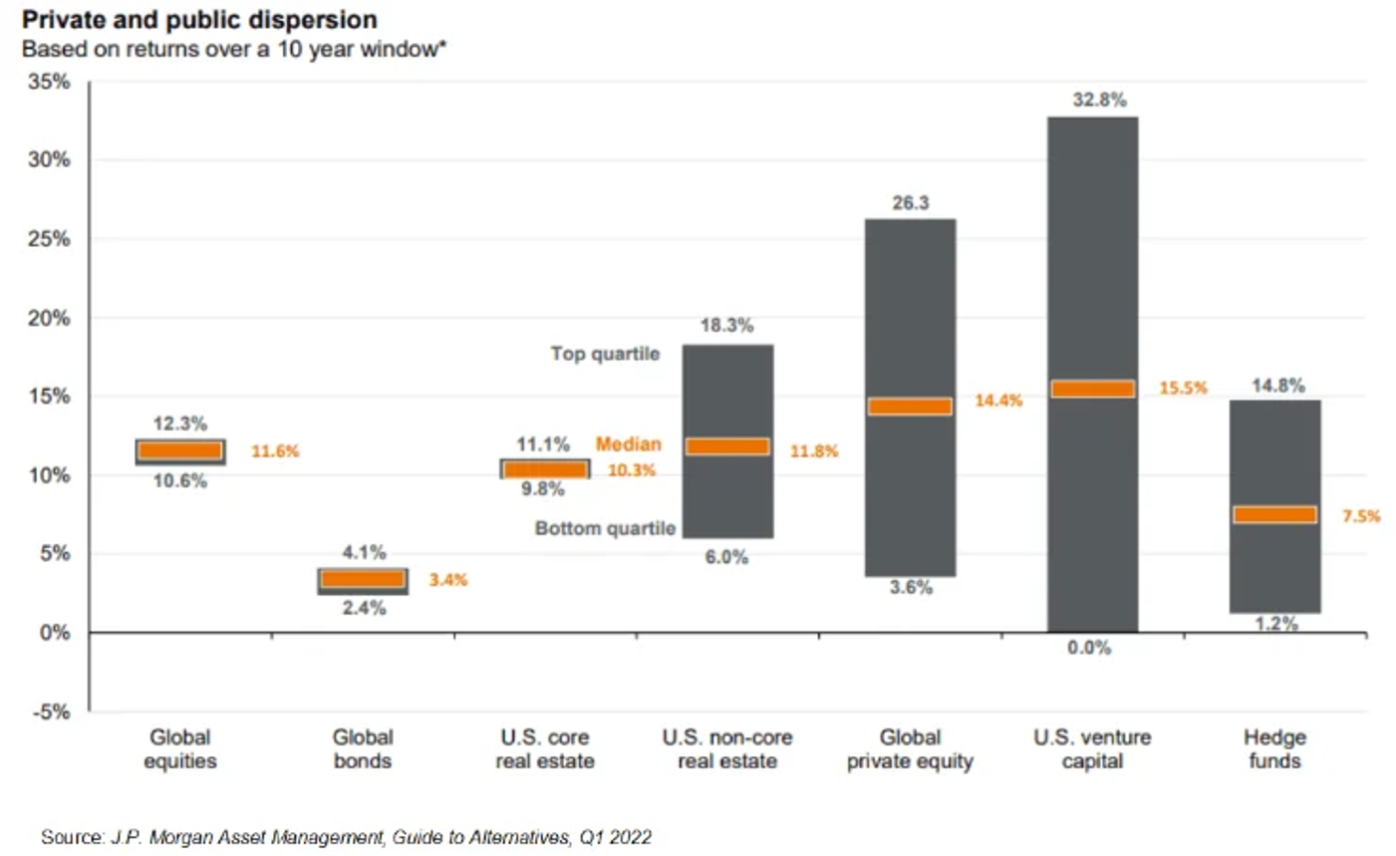

Not only is venture a patient asset class, it is also unique in it’s tolerance for risk. Venture funds ask for no collateral and take minority stakes into businesses whose financial plans are based predominantly on assumptions rather than facts. In the process they value these businesses, and thus reward entrepreneurs and their employees, for assumed successes many years into the future, rather than on what they have achieved to date. This is the most founder and employee friendly form of financing possible beyond direct grants. It gives ambitious entrepreneurs and technologists the time to make mistakes, iterate and try again many times over. If it hadn’t been one of the best returning asset classes in the world, you wouldn’t believe it could work.

And it does work. The numbers are well known but still astounding. Over 50% of the companies and 70% of the market cap of the S&P500 are made up of venture backed businesses. Venture-backed companies have created jobs eight times faster than the rest of the economy since 1990. Top quartile venture funds have returned over 27% net IRR since 2012. A vast majority of the technological advances in software, financial services and life sciences in the last couple of decades can be attributed to companies that in many cases wouldn’t exist without venture, and in all cases couldn’t have scaled as quickly as they did.

And as I argue in more depth in my book, Start-Up Century, venture capital is even more important as the world looks to accelerate technologies in areas as important as clean energy, healthcare and AI in the face of growing environmental and social challenges. If you are pro-technologically driven abundance, venture capital is the perfect asset class.

Of course, there are plenty of valid criticisms of venture capital as well, and I’m not suggesting it is a panacea for all the world’s, or a company’s, ills. I don’t need to detail here the many failures of governance and occasionally destructive behaviour some individual investors have shown recently. It’s still sad to me that some venture investors, who have the opportunity to help build enduring and transformational tech companies, choose to invest into pictures of digital apes. But such issues are overwhelmingly the exception, not the rule.

And advances in AI are changing the dynamics of building a venture-backed business. As the cost of building software, creating content or communicating with customers falls dramatically with Generative AI, businesses will require fewer resources or employees to scale to $100Ms in revenue (another phenomenon covered in Start-Up Century). Some founders may need far less capital to build impactful businesses, making venture dollars less attractive.

But even with advances in AI changing parts of the industry for better and worse, venture remains one of the most important asset classes for founders, for consumers and for growing the economy and is worth writing about.

As well as welcoming any new venture funding, this is a another important milestone for both European tech and for Balderton, which becomes one of the few firms ever to get get into double-digit fund numbers.

I have now been through 8 successful fund raises as a partner at Balderton. In every fundraise I’ve been through, existing and new investors naturally dig into the obvious questions around our performance, team, strategy and references. However this time the questions on the market were very different.

When I started in European venture almost 15 years ago, the first discussion you had to have with any potential investor in our funds was ‘why would I invest in European tech?’. The term was considered an oxymoron in some circles. European government policy aimed to prop-up big companies rather than encourage competition. Strong service economies sucked entrepreneurial talent into finance or law. A lack of cultural support for risk-taking meant you were treated as weird if you decided to throw in your stable if unsatisfying job maintaining IT systems to become a software engineer at a low prospects start-up. Many of the best technology entrepreneurs in Europe naturally ended up in the Valley.

That was the environment I joined Balderton in. However over the last decade the environment for technology companies started in Europe has changed dramatically, and with it the ability to raise risk capital.

Across the continent, more people than ever are starting businesses, part of a global entrepreneurial trend. Many countries have put forward more entrepreneur and venture friendly policies - like the UK’s SEIS scheme, France’s Tibi programme and Germany’s recent reforms of employee stock options. Perhaps most importantly the scale of ambition has changed - founders are increasingly celebrated and entrepreneurship venerated to a much greater degree than it was a decade ago. In the UK alone, a recent report showed that the proportion of working-age population already running or planning to start businesses has more than doubled in the last two decades.

As a result, total venture funding in the UK & Europe has grown almost 10x since 2010, reaching over $60B in 2023. While Europe still lags the US per capita, it is closing the gap, especially in the UK. And while the sample size is smaller, European VC funds outperformed North American funds over both a 10 and 15 year period, according to data from Invest Europe and Cambridge Associates. If you had been long European tech in the 2010s and saw the opportunity early, you have likely been rewarded. We almost never get asked ‘why Europe?’ anymore.

However, instead of ‘why Europe?’, we now get asked a much more difficult question, why you? Balderton was one of only and handful of venture funds when I joined in 2012. Even with a tiny team ( there were just three non-partners back then ) we managed to see around 90% of all companies that raised a Series A.

Today, however, many other funds have recognised the scale of the opportunity here. As a founder in Europe you are spoiled for choice for the type of partner you may want to work with. There are solo-GPs offering everything from deep sector expertise to ‘equity for media’ deals (yuk). There are global funds with many billions under management offering able to deploy $100Ms in single rounds. There are corporate venture arms dangling offers of exclusive distribution or discounted GPUs. So, why us?

The first answer to that is that we have put a huge amount of effort to tailor what we offer to founders and be actually useful in ways that matter to them.

We’ve done this in the way we have built the firm. We have a wide range of experiences in our partnership, having lived through the journey from Series A to IPO or multi-billion M&A as founders, board members and operators. We are an equal partnership, which means none of the partners get additional incentives for the specific investments they lead. We have built phenomenal in-house support for our founders with our legal, finance, marketing, talent and other functions, investing heavily to make sure that you don’t need to rely on expensive external contractors in those areas. We have a free experts-in-residence team, to provide both individual mentoring and general advice in areas like GTM and your tech stack. And we have built a unique offering to our founders to support their physical and mental well being, with free personal health and nutrition advice from world experts and support for childcare. Combined, we believe ( and feedback surveys support ) our view that we offer a compelling platform for founders that goes beyond just capital allocation.

We are also fortunate to be differentiated in the community around us. We have invested in over 250 founders over the last two decades, who have seen success and failure. That community help each other through our CEO forums and C-level specific networks and surveys of our founders consistently highlight the surprisingly powerful impact that being part of that Balderton community has been for them.

But in my view our most differentiating factor, and the way I always answer the question ‘why you?’, is conviction. Conviction is the difference between founding a company and just day-dreaming about it. Conviction is the difference between risking your career on a start-up and choosing the trodden path. And conviction is what makes a great partner in a venture investor, and lack of it a poor one.

We hone this conviction in many ways. We run many ‘deep dives’ into how technology is changing specific industries and business models every year. We develop it through debate and our experiences as a team over 100s of investments. And we build it through the 1000s of conversations we have with entrepreneurs every year.

Conviction matters because despite the ten-fold increase in venture dollars available to founders, and the many types of funds scouring Europe for founders, there is still a desperate lack of conviction in the non-consensus founders and technologies that can build generational companies. As any founder will tell you, there is no shortage of low conviction investors, willing to jump on a hot trend or pattern-match a CV - who might then drop you as soon as the numbers miss or the sector goes cold. High conviction investors are still in short supply, and so despite the general growth in venture dollars available, only half of the investments we make are actually competitive, because we have got to conviction in a founder, technology and business when other funds haven’t.

While we have made mistakes as investors over the years, we have never done so because we lacked conviction.

So I can proudly say that the news of Balderton’s latest fundraise is worth writing about. It’s good news to have more capital going into companies that can move the needle of productivity. It’s good news for the European ecosystem we focus on. And it’s good news for founders who want to work with high conviction investors. If that’s you, get in touch!